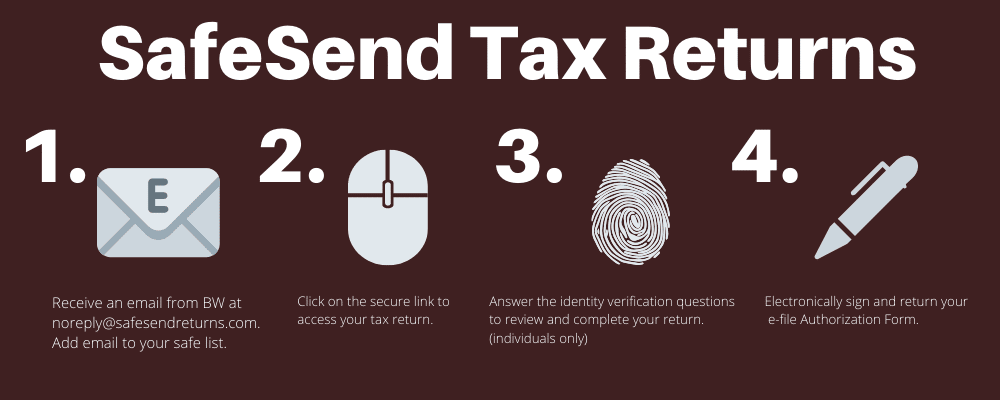

To ensure our clients have the best experience and seamless communication with our team during tax season, Barnes Wendling CPAs offers SafeSend Returns, an automated process for all individual, business, and trust income tax returns utilizing SafeSend™ technology. This tax system is easy to use and will give our clients confidence with the delivery of their tax returns.

Having trouble picturing the process?

Here is a video tutorial to show you what to expect each step of the way: SafeSend Returns Walkthrough Video

Frequently Asked Questions

- What if I don’t receive an email with my access code?

- Check your spam/junk email folder. You can also search your email for noreply@safesendreturns.com. If you haven’t received a code within the 10-minute time limit, request another code.

- Will this work on any internet- connected device?

- Yes, you can complete this process on any computer, smartphone, or tablet.

- If I want to print and sign my e-file authorization form(s), do I need to print and send back the entire tax return?

- No. You don’t need to print and mail your whole return.

- We only need Form 8879, IRS e-file Signature Authorization, as well as any required state and city e-file authorization forms to complete the e-filing process.

- After signing my e-file authorization form(s), will I receive confirmation that it was successfully submitted?

- Yes! Once you sign your e-file authorization form(s) you will receive an email stating it was successful. The email will also include a link to download a copy of your tax return for your records.

- Can I set up reminders for my quarterly estimated payment?

- If estimated payments are included in your review copy, you will automatically receive an email reminder 14 days before your payment is due.

- How is this different from e-filing?

- SafeSend Returns allows you to electronically sign your individual e-file authorization form(s), but it won’t submit your return to the IRS. Once signed, Barnes Wendling CPAs is automatically notified, and we will then complete the filing process for you, including submission to the IRS.

Interested in SafeSend?

If you have any additional questions, please feel free to contact our office at (216) 566-9000 or complete the below form. You may also find assistance through SafeSend’s Help Center.