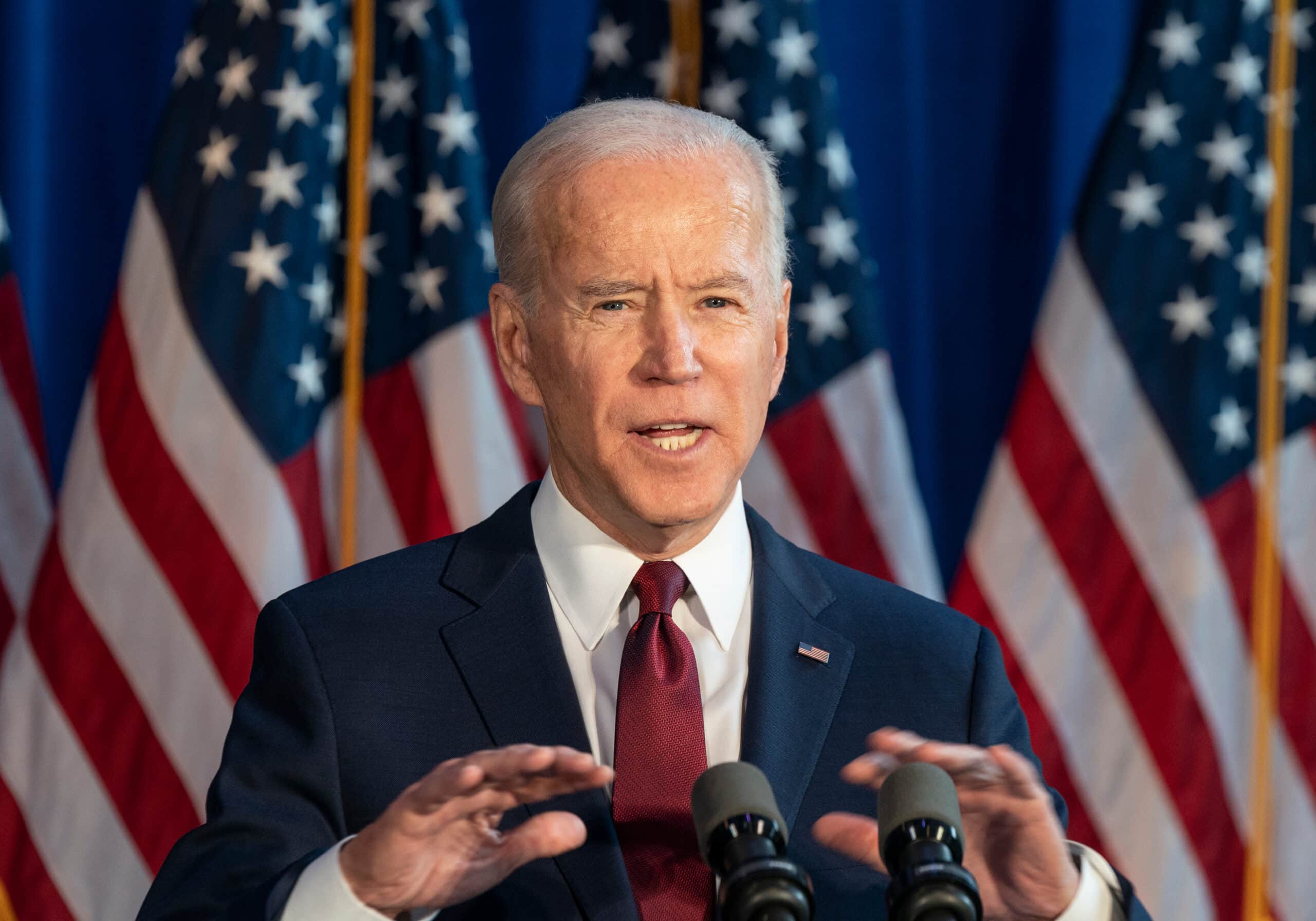

President Biden’s budget proposal includes noteworthy tax provisions

President Biden has released his proposed budget for the federal government for the 2024 fiscal year. The budget, which aims to cut the deficit by nearly $3 trillion over 10 years, includes numerous provisions that would affect…